Foreign investment into Australian commercial property

There’s been much said about the current uncertainty surrounding the global banking situation and the potential impacts for the broader economy.

There’s been much said about the current uncertainty surrounding the global banking situation and the potential impacts for the broader economy. Latest data from Treasury surrounding foreign investment into Australia has been released for the quarter, ending December 2022, which shows a continued commitment to property investment from offshore groups. With the increased cost of finance and recent developments regarding the accessibility of funds, will we see these strong levels of foreign buyer demand continue?

During the December 2022 quarter, commercial property was the largest industry sector requiring Foreign Investment Review Board (FIRB) approval. The values of approvals recorded were $19.3 billion ahead of “finance and insurance” and “manufacturing, electricity and gas”, both recording $12.9 billion, while residential property sat at just $1.4 billion. Office and industrial were the most active asset types transacted over this period, while investment into retail and development sites had increased on the prior quarter.

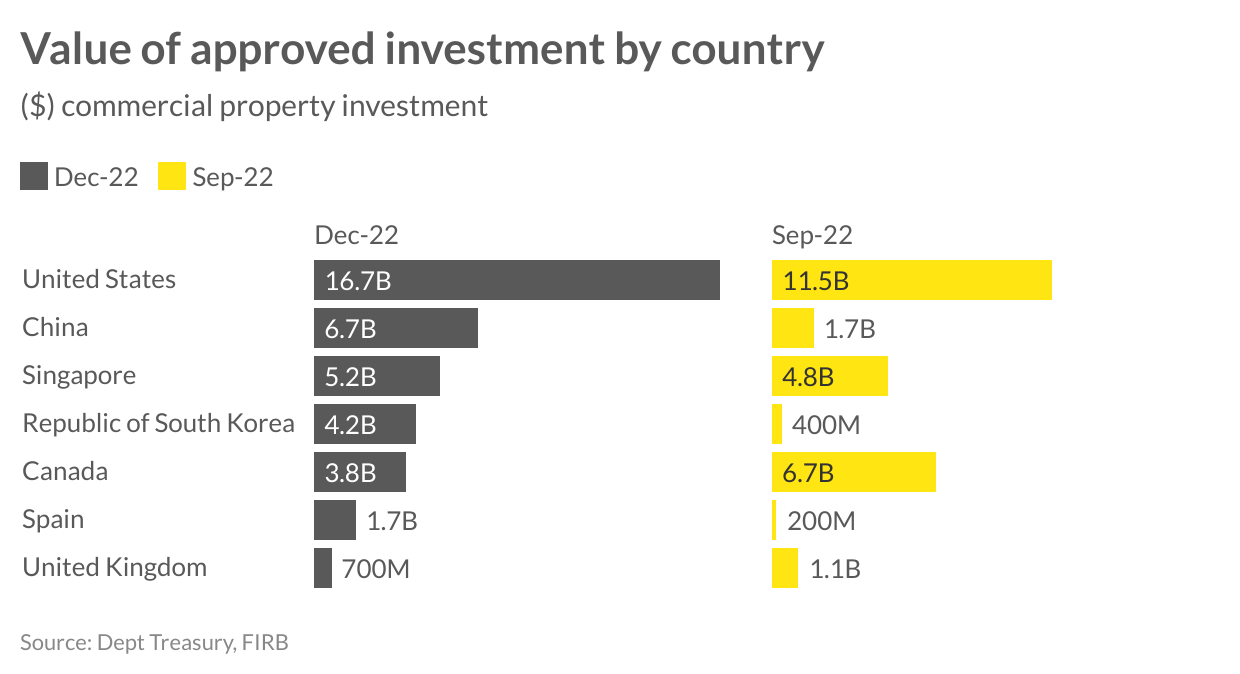

The United States continued to be the most active source of investment capital into Australia, growing 45.2 per cent compared to the prior quarter. Historically, the US is the largest investor of commercial property into Australia, last year (2021/22) purchasing $118.9 billion worth up from $57 billion in 2020/21. Canada is also a strong investor into Australian property, with a strong appetite for quality, trophy CBD office assets. Given the weight of funds available via Canadian pension funds and listed vehicles, we’ve seen fluctuating results inline with the larger sales Canadian funds are known to be involved in. It’s anticipated that financing will become a stumbling block for some larger institutional vehicles, which may see a stabilisation of investment out of North America.

Singapore has picked up their investment over the last 18 months, particularly in the hotel and leisure sector. Over the September and December quarters, investment remained stable, totalling $10 billion, after $24 billion in sales during the prior financial year. China/Hong Kong’s investment into commercial has decreased over the past few years, however, this current quarter has shown strong results with retail and hotel being the asset type of interest.

Also in Asia, South Korea is a market which has been increasing its holdings into Australia, across all asset classes. This period, we’ve seen $4.2 billion in investment already, approaching the full 2021/22 results of $4.5 billion. These markets are anticipated to continue to seek out investment opportunities this year and may favour the Australian market to the North American and European markets given banking uncertainty. Japan may continue its quiet start to the financial year, with just $1.4 billion changing hands in 2022/23 after achieving $7.1 billion the year prior.

Across the residential market, China and Hong Kong are the greatest investors into property, with this tipped to increase during the first half of this year given the change in online student learning in China, which has already seen an uptick in foreign student numbers and demand to purchase increase.

Europe has been reducing their investment into Australia more recently, which is expected to continue during this year as the banking crisis unfolds. The United Kingdom has only recorded $700 million in sales during the December quarter, with full year results anticipated well behind the $6.5 billion recorded in 2021/22. Markets such as Germany have been quiet this financial year with Spain and Czech Republic showing some increase in investment across various smaller assets.